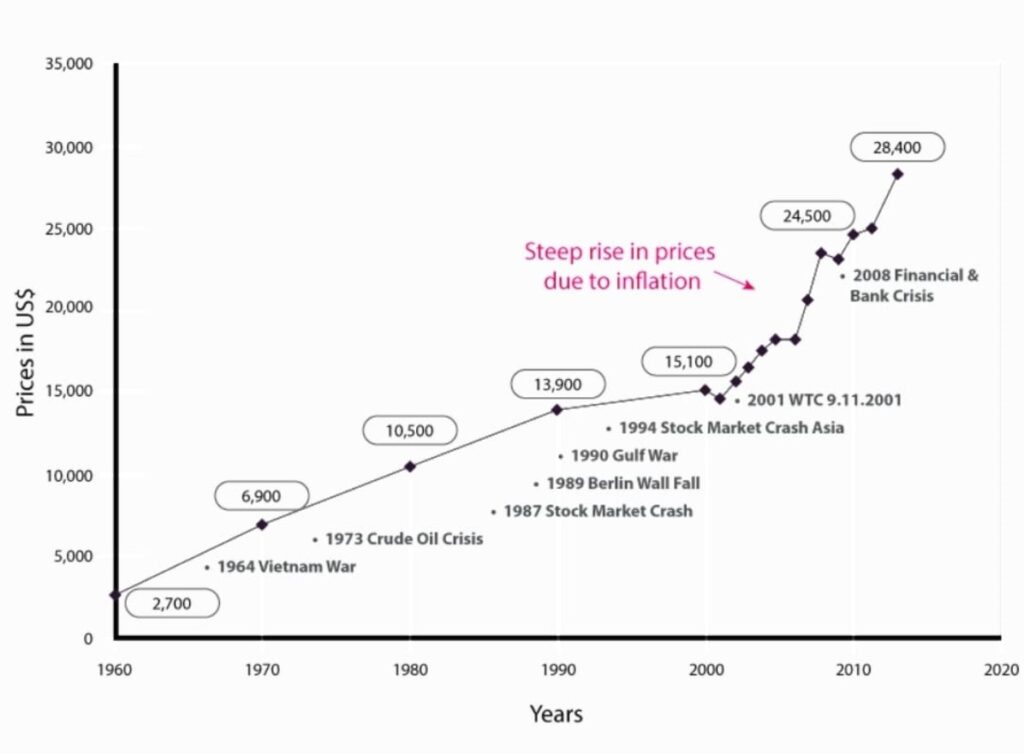

We have compiled a comprehensive analysis of diamond price appreciation over the past 30 years, represented in a detailed chart that showcases the fluctuations and trends in diamond prices over this period. This chart has been meticulously created using data sourced from reliable institutions and government publications, providing an accurate and thorough depiction of the diamond market over the past three decades.

It serves as a valuable resource for investors, jewelers, and anyone interested in the diamond market, offering insights into the past that may help inform decisions for the future.

Graph Statistics

Historical data from 1960 to 2016 shows that diamond prices increased by about 14% annually, equivalent to a yearly compound interest of 4.3%. However, past performance does not guarantee future performance.

Diamond Price Appreciation: A Comprehensive Guide

Diamonds, rare and alluring gemstones, have always been highly valued since their discovery. The worldwide diamond industry has evolved over the past half-century, influenced by various factors such as economic growth, demand for luxury goods, decline in diamond mining, and changes in market control. This guide aims to provide a detailed analysis of the key factors affecting diamond prices and their historical trends.

Key Trends

- Global Economic Growth: Economic growth worldwide has led to increased demand for luxury goods, including diamonds. This has been particularly noticeable with the continued economic growth and the decline in diamond mining, leading to an expected 6% annual increase in high gem quality natural diamond prices until 2020.

- Historical Price Increase: Over the past ten years, diamond prices have increased by approximately 32-33%, averaging 4% annually.

- Market Share Shift: De Beers’ market share has fallen from 90% in the 80s to around 30%, indicating that diamonds can hold value even without a large corporation controlling supply.

- Investment Potential: Contrary to some opinions, diamonds can be a good investment if purchased close to wholesale price and of top gem quality. Despite significant markups in retail, diamonds remain a highly sought-after commodity.

- Standard Price Benchmark: Unlike other natural gemstones, pure natural diamonds have a relative standard price benchmark, influenced by Rappaport and market forces, allowing for more accurate value evaluation.

Detailed Analysis

Demand and Supply

The demand for diamond jewelry has always been a significant factor affecting diamond prices. With global economic growth, diamond demand is expected to outpace production growth due to current mine slowdowns and the lack of new mine discoveries. This imbalance will likely affect global prices and lead to price fluctuations influenced by external economic factors or internal trader expectations.

Price Fluctuations

Diamond prices have experienced both increases and decreases over the past decade. For example, prices decreased by more than 12% in 2008 due to the financial market collapse but increased by a record-breaking 20% in 2011 due to higher demand. These fluctuations are influenced by various factors, including changes made by manufacturers and wholesalers, diamond size, and global economic conditions.

Size Matters

The size of a diamond significantly affects its price. Larger diamonds (3 carats and above) experience more price fluctuation compared to smaller diamonds (up to 2.99 carats). Over the past 15 years, larger diamonds have more than doubled in price, while smaller diamonds have experienced smaller price changes.

Colored Diamonds

The popularity and sales of colored diamonds have increased significantly, led by Asian investors. From 2006 to 2014, colored diamonds appreciated by approximately 154.7%, while colorless diamonds increased by an estimated 62.4%. This increase in demand and rarity has led to higher prices for colored diamonds.

Cartel Structure Decline

The diamond industry has evolved over the past 50 years, with a notable decline in the cartel structure once dominated by De Beers. This has resulted in more volatile diamond prices due to increased demand and decreased supply.

De Beers’ Influence

De Beers’ reducing stockpile and change in business policy have affected the diamond market. The lack of new diamond deposit discoveries and decreased diamond production have led to increased prices. De Beers’ market share has reduced from 90% in the 80s to around 33%, affecting diamond prices.

FAQs

Are diamonds worth more now than 10 years ago?

Yes, generally speaking, diamonds are worth more now than they were 10 years ago. The value of diamonds has been influenced by various factors including inflation, changes in demand and supply, and economic conditions. However, it’s important to note that the value of a diamond also depends on its quality, size, and rarity.

Do diamonds ever appreciate in value?

Yes, diamonds can appreciate in value over time. Factors that contribute to the appreciation of diamonds include increased demand, inflation, and the rarity of the diamond. High-quality diamonds, in particular, have shown a strong appreciation in value over time.

Have diamonds been a good investment?

Diamonds have historically been a stable and valuable investment. While the value of diamonds can fluctuate due to economic conditions, they have generally appreciated over time, especially high-quality and rare diamonds. However, it’s important to note that investing in diamonds carries risks, as with any investment, and past performance is not indicative of future results.

How much would diamonds actually be worth?

The value of a diamond is determined by its carat weight, cut, color, and clarity, commonly known as the 4Cs. Other factors that can influence a diamond’s worth include its shape, fluorescence, and any inclusions or blemishes. It’s important to get a diamond appraised by a certified professional to determine its actual worth.

Check Salary Inflation Calculator

Conclusion

Diamond prices have experienced significant changes over the past few decades, influenced by various factors such as global economic growth, demand and supply imbalance, diamond size, and changes in market control. While diamonds can be a good investment, it is essential to consider all these factors and purchase from trusted sources at close to wholesale prices. Additionally, the decline in the cartel structure and De Beers’ influence indicate that diamond prices will likely continue to fluctuate due to increased demand and decreased supply.